This week’s review covers analysis of the November statistics published by the Reserve Bank of Australia (RBA) and Core Logic. This information tracks market performance to 31 October 2020.

With the RBA dropping the cash rate to 0.1% and all levels of government doing whatever they can to heat up the economy, we’re seeing evidence of the market swinging swiftly back to a sellers’ market.

Of course, it was largely unit prices that took a hit while houses stubbornly resisted any downward price pressure during the virus crisis, but now we’re seeing a recovery for ‘off the plan’ and units in general.

The ‘Housing Prices’ graph below shows national prices are approximately 5% off the most recent peak from December 2019, but there’s significant indicators that we’ve experienced the end of any downward trends.

The trend change can be seen in the ‘Capital City Performance’ graph which shows price trends between March 2020 and October 2020 and tracks a clear bottoming out at the end of September.

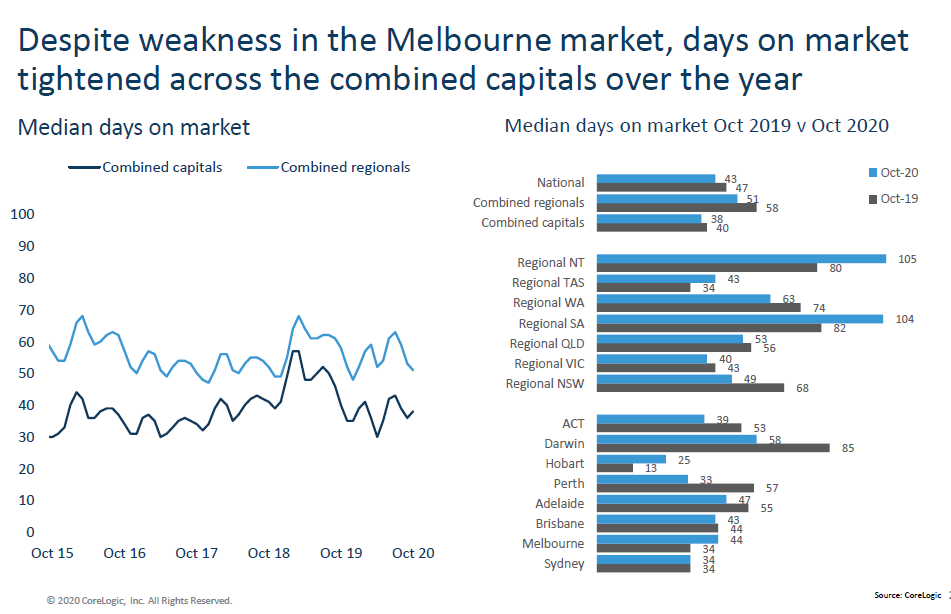

Other key indicators of trend changes, note the number of days on market graph which shows Sydney and Brisbane have the same number of days as October 2019 (as the market fired up), and Adelaide and Perth with a lower number of days on market than the same period last year. Notably, Perth is significantly down from 57 days to 33 – a major flag that prices are about to bounce there.

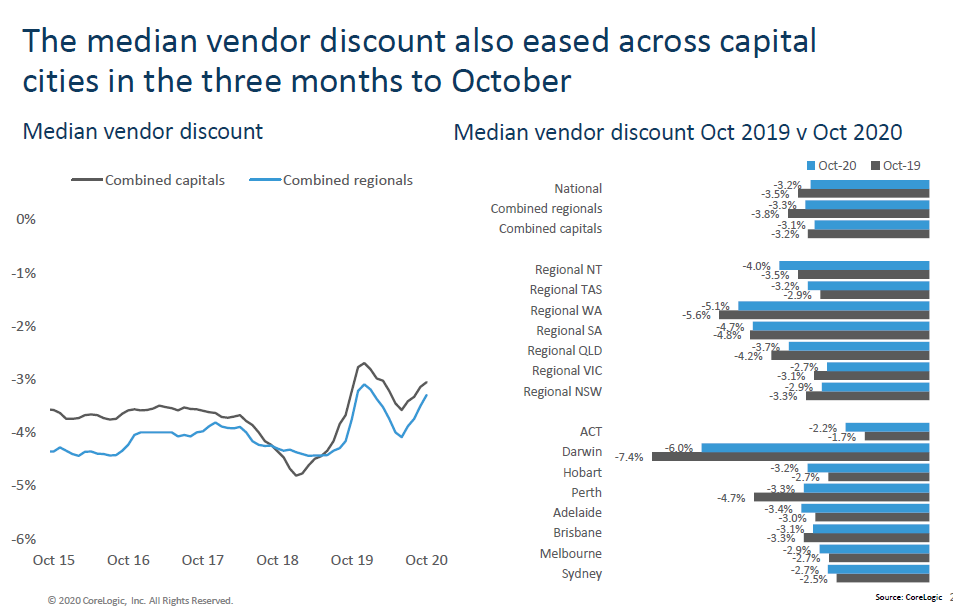

The vendor discounting indicators are also pointing to market increases. There’s very minimal changes in vendors discounting their asking price in Sydney, Melbourne, Brisbane and Adelaide when compared to this time last year.

Once again, Perth is a standout with the amount of discounting down by almost a full percentage point. This means more buyers are purchasing at the asking price, and will lead to price increases if the trend continues. Prices in Perth have been low for some time, so there will be a little sales bounce for profit takers (where owners will put their properties on the market) but stock is so low price increases won’t be too far away.

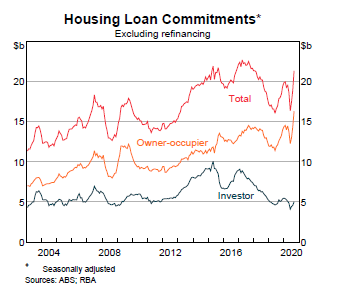

The remaining graphs show sales volumes are 5.4% higher over the past 12 months despite the virus impacting sales practices, and we can also see (the last two graph sets) which show it’s home buyers – not investors – who are the biggest buying groups. No doubt with changes to restrictive lending practices we will see investors storm back into the market in the coming weeks.

[For those of you who are really interested in the details . .yes . .these two charts report to September activity – this is the most up to date data the RBA + CoreLogic can access as at 31 Oct 20.]

About the author

Debra Beck-Mewing is the Editor of the Property Portfolio Magazine and CEO of The Property Frontline. She has more than 20 years’ experience in buying property Australia-wide and has extensive experience in helping buyers use a range of strategies including renovating, granny flats, sub-division and development. Debra is a skilled property strategist, and a master in identifying tailored opportunities, homes and sourcing properties that have multiple uses. She is a Qualified Property Investment Advisor, licensed real estate agent and also holds a Bachelor of Commerce and Master of Business. As a passionate advocate for increasing transparency in the property and wealth industries, Debra is a popular speaker on these topics. She is also an author, podcast host, and participates on numerous committees including the Property Owners’ Association.

Follow us on facebook.com/ThePropertyFrontline for regular updates, or book in for a strategy session to discuss your property questions.

Disclaimer – This information is of a general nature only and does not constitute professional advice. We strongly recommend you seek your own professional advice in relation to your particular circumstances.