Less than two weeks out from the spring selling season of 2021, lockdown conditions are in place across the ACT, Greater Melbourne, and NSW. More recently, major centres across the Northern Territory have been plunged into a snap lockdown.

In the decade prior to COVID-19, sales and listings volumes would typically rise from September to November. The seasonal impact on prices is fairly marginal, as both buyer demand and property supply would increase over the season.

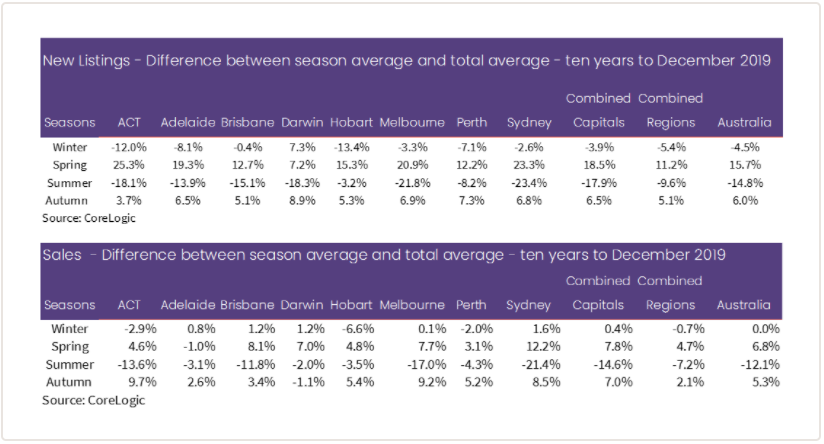

The tables below show the percentage difference between average sales and listings numbers through each of the seasons over the past decade and the average for the entire decade. In this instance, the numbers reflect the ten years to December 2019, prior to COVID-induced lockdowns across Australia.

The data shows that on a monthly basis, new listings added to the market for sale increased 15.7% nationally compared to the full decade average (where new listings are advertised stock that has been freshly added to the market over the course of the month). This equates to a historic average of around 42,100 new listings added to the market monthly over the past decade, compared with 48,700 through the months of spring.

Sales volumes do not see as strong a seasonal effect, with around 40,000 transactions across Australia through the months of spring, compared with 37,500 across the full decade average.

Both sales and listings tend to be most seasonal in the capital cities rather than the regions, with the uplift in new listings volumes particularly strong across springtime in Sydney and the ACT. In order to understand what this means for regions now in lockdown, some insight can be gained from housing market outcomes through Melbourne last year.

Lessons from 2020 lockdowns

Observing housing market performance through lockdowns reveals that both sales and listings volumes will fall through lockdowns. This means transaction activity is likely to be subdued across Melbourne, the ACT, and NSW through the duration of the current lockdowns.

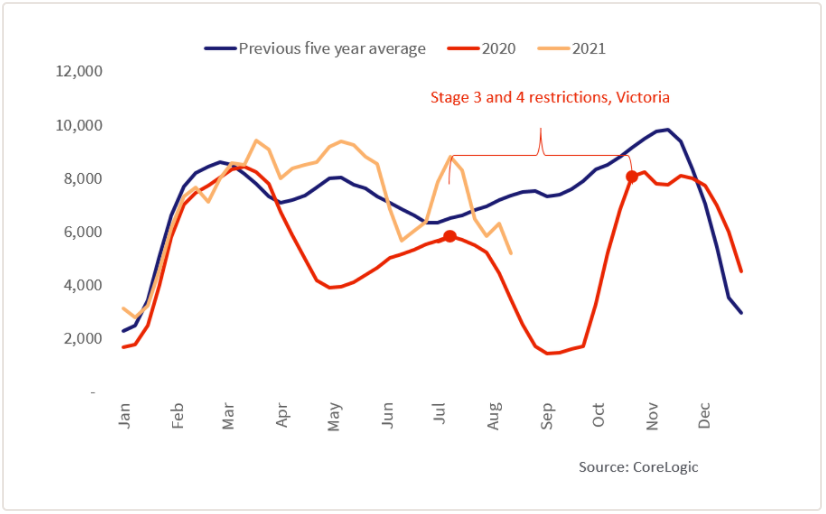

Greater Melbourne was subject to a second wave of restrictions in 2020, from mid-July to late October, well into the spring of 2020. The chart below compares the rolling 28-day count of new listings added to the market over the year, compared with the previous five-year average, and 2021.

The chart shows a rapid and substantial reduction in new listings being added to the market over the course of the lockdowns through the second half on 2020, at a time when new listings would usually be rising consistently. At its lowest count, just 1,411 listings were added to the market for sale in the four weeks to September 6th, which was 80.7% below the previous five-year average.

A combination of factors led to depleted listings in lockdown, including:

- Low levels of consumer confidence, and the belief that vendors may not get an optimal price for the sale of their property

- Mortgage repayment deferrals and government household support, which limited the sale of distressed property – ie, less people were forced to sell

- Property being harder to transact, as inspections and auctions were increasingly conducted virtually

As the easing of restrictions was announced towards the end of October, new listing volumes began to rise rapidly, showing the elasticity of vendor behaviour around restrictions. Newly advertised stock recovered remarkably quickly following the easing of restrictions.

Interestingly, new listings volumes through December 2020 trended an average 40.4% higher than the previous five-year average, suggesting the spring selling season of 2020 was ‘pushed back’ into the final months of the year. 2021 is also presented in Figure 2, which shows more volatility in listings volumes through shorter lockdowns, with volumes continually recovering as restrictions ease. New listings through 2021 are also more elevated than the previous five-year average, which may in part be the result of postponed selling decisions through lockdowns coming onto the market as COVID-19 cases were more contained.

A similar trend can be seen in Melbourne across sales activity, which has also been subdued through extended lockdowns, but recovers strongly afterward. This is because the relative stability of the economy and housing market through COVID has meant that housing purchasing decisions were more likely to have just been postponed through lockdowns, rather than abandoned altogether. Another interesting feature of sales volumes through the COVID period is that the easing of restrictions has defied seasonal trends. Suppressed sales activity through lockdowns actually led to an increase in sales across Melbourne in December of 2020 and July 2021, a time when seasonally, sales volumes would usually be far more subdued.

Across Greater Melbourne, the ACT, and NSW, similar declines in transaction activity are already very apparent. In Sydney for example, new listings added to the market have been trending down since the announcement of city-wide restrictions in late June (Figure 4). Sales volumes across Sydney fell -7.4% in June and -2.7% over the month of July.

Despite the current slowdown in transaction activity, previous lockdown conditions have seen a robust recovery in sales volumes and vendor activity. There are tailwinds in place for housing market demand to suggest this may happen again; household savings rates remain elevated, new average mortgage rates continue to reach new record lows, and many government fiscal stimulus and broader institutional responses have been resurrected amid renewed lockdowns. This could see elevated transaction activity through the summer of 2021/2022 should restrictions be eased by then.

However, headwinds for the housing market should also be considered. Rising affordability constraints had already seen a downward trend in first home buyer activity since the start of 2021. Some arrangements that supported economic and housing conditions through 2020 lockdowns, such as JobKeeper and HomeBuilder, have not been re-surfaced this year for regions in lockdown, and may dampen the rebound in demand. Another factor to consider is the more uncertain nature of the delta variant, with this more contagious strain of the virus having the potential to make lockdowns more frequent until the vast majority of Australians are vaccinated. This could disrupt income streams, impacting the robustness of housing demand.

A key trend to watch for as lockdowns are lifted is whether a lift in new advertised supply is met with a commensurate lift in buyer activity. With affordability constraints becoming a larger obstacle in the market, as well as the potential for tighter credit conditions further down the track, if buyer activity does not match the lift in listings we could see a gradual rebalancing between sellers and buyers.

The past twelve months have seen demand outweighing advertised supply, creating strong selling conditions and some urgency amongst buyers. If supply and demand become more evenly balanced, this could be another factor dampening the level of value growth later this year.

This article first appeared in Corelogic.