The SMSF Association (the preeminent independent, professional body representing Australia’s self managed super fund sector) and Rice Warner Deloitte actuaries, prepared a report looking at the costs of operating self managed super funds (SMSFs).

The research is based on both published fee structures and actual data from more than 100,000 SMSFs. It establishes the size at which an SMSF becomes viable.

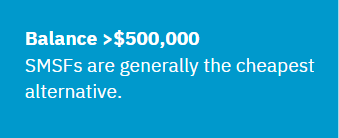

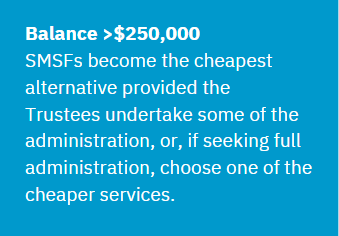

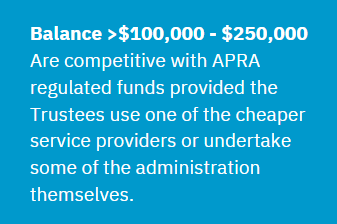

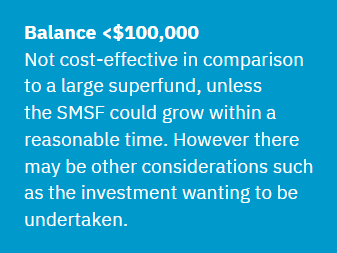

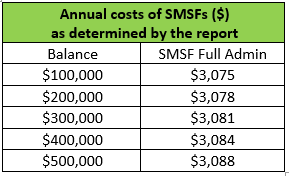

Check out the table which shows the comparisons between the cost to maintain the SMSF measured against the total amount of funds in the SMSF.

SMSFs with $200,000 or more are cost competitive with both Industry and Retail funds.

Fees (excluding statutory fees) relative to inflation, have fallen over the past 7 years with the use of technology, making SMSFs more cost effective for those with smaller balances.

The bulk of small SMSFs either grow quickly or are closed. SMSFs paying pensions are comparable to those accumulating funds.

The SMSF sector has delivered equivalent returns to those of the APRA sector since 2005 in both good years and bad years.

Other considerations

Advantages

- Greater control

- Greater flexibility

- Greater security

- Broader investment opportunities

- Taxation advantages

- Contributions can occur by transferring existing assets

- Investment continuity

- Estate planning opportunities

- Asset protection

- More tailored life insurance options

- Permanency

Disadvantages

- Responsibility

- Costs

- Complexity

- Potential penalties

- Time commitment

- No access to Government compensation schemes

- No access to the Complaints Tribunal

- A breakdown of relationships between the trustees

This article first appeared in vincents.com.au.